Since the olden days, gold has always been considered the safest heaven of investment during financial crisis.

That’s because, gold is a rare metal with immense demand and it can be used as a medium of exchange or barter.

The world is now seeing the financial crisis brought by the COVID-19 pandemic and is on a rage to hoard gold.

This led to shoot-up of the gold prices during 2019- 2020.

This according to experts is the best time to invest in gold as the prices will only accelerate further higher. They also suggest an investment of 10-15 % of the portfolio to be invested in gold as a norm of diversification of funds.

Remember, investment in gold jewelry is not considered as an investment. It is in the nature of consumption. Gold jewelry also attracts expenses like making charges, maintenance and polishing charges, import duty and GST on purchase.

Now the question arises, ” if gold jewelry is not the best form on investment, then what is ?”

This article is all about cracking the question in detail and comparing the various gold instruments available in the market. This article will help you compare the facilities available, charges involved and the net returns.

Starting with the types of Gold instruments available in the Indian Market.

Here they are :

Physical gold – Biscuits, coins and bullions

Gold Exchange Traded Funds

Gold Mutual Funds, a.k.a funds of funds.

Digital Gold – Click here to purchase gold online and get it delivered to the ease of your home.

Sovereign Gold Bonds – To know more about the Sovereign Gold Bond scheme 2021-2022, Click here to know the price details, how to buy and from where.

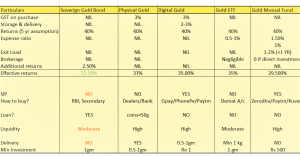

These are the various avenues of gold investment available in the Indian market and here is a comparison of their risks and returns.

The minimum return assumed on gold here is 8 % p.a and the period of holding being 5 years.

You can see from the chart above, that Sovereign Gold Bond is the clear winner with the highest returns and the advantageous facilities.

Annexing the explanation here –

No GST : There is no GST charged on purchase of SGB while 3% GST has to be paid if Digital Gold and Physical gold is bought.

Fixed Interest : In addition to the appreciation of gold value, a fixed interest of 2.5%p.a will be paid semi-annually to the SGB holder. This interest will however be taxable as per the slab rate under Income from other sources.

Moderately liquid even before 5 years

I have only assumed a minimum of 8 % p.a return. But the scenario of COVID-19 will help in spiking the gold prices further. Experts believe a spike up to Rs 80,000 per 10 gm of gold in the coming 5-10 years in comparison to around Rs 50,000 being the current market price.

Since gold is a scarce resource and the demand for gold jewelry, gold chips in electronic devices will always be there, gold prices can be expected to rise in the coming future owing to the COVID-19 scenario.

Its a well accepted rule, that when supply is scarce, the demand grows and so does the price.