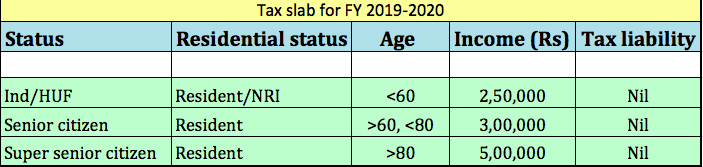

I hope you know this tax slab for financial year 2019-2020

You do not have a tax liability of you fall under any of the above criteria.

Please note, these tax limits are applicable for financial year 2019 -2020.

A new tax regime has been announced in Budget 2020. It is flexible in giving taxpayers an option to choose between the old tax limits and a newly framed tax slab. This option is available from FY 2020-2021.

The new tax regime is a topic of discussion for another day.

As of now, if you think you are escaping filing of income tax returns this year, wait!

There’s more! Read on.

You MUST file your Income Tax return, if you fulfil ANY of the following 3 conditions –

- Have you deposited amount or aggregate of amounts exceeding Rs 1 crore in one or more current account during the previous year ?

- Have you incurred expenditure of an amount or aggregate of amount exceeding Rs 2 lakhs for travel to foreign country for yourself or for any other person?

- Have you incurred expenditure of amount or aggregate exceeding Rs 1 Lakh on consumption of electricity during the previous year?

If you fall under any of the above category and somehow your earning on paper is below the taxable limits, avoid trouble!

File your income tax returns before the due date. I’m sure, you do not want to invite a penalty or notice from the Income Tax department!

Now, let me come to the crux of this article.

Should you file an income tax return if your earnings are below the taxable limits? No. It is not mandatory.

So you may ask, why should I file my ITR if it is not mandatory for me?

The answer is, ITRs help you save yourself from uncertainties.

What? How is that?

I have listed a few situations for you in this article.

Situation 1.If in the future you want to turn your dream of having a house of your own into a reality, but are falling short of capital, what do you do?

You seek a bank’s help for a home loan.

The first thing, a bank will ask you, is to provide for a proof of income or a proof of constant money flow for the past 3 years.

Remember, banks wont risk a loan to a borrower without any income! What if the loan turns into a non-performing asset?

This proof of income, dear friend, is your income tax return!

Imagine situation 2. If you have a brilliant child and want to seek an education loan for his higher studies, the bank would want to check your repayment capacity.

As per the RBI guidelines, banks have been strictly instructed to collect Income Tax returns of borrowers.

Your salary slip or your bank credits will not serve as proof of income. Income tax return serves this purpose. It is considered much credible than salary slips.

Now, if you haven’t filed a ITR, your child might miss an opportunity in his life because of your negligence and ignorance.

3. Imagine you and your friend decide to start a business and be your own boss! Sounds amazing, right?

You work hard, you get more customers and then you decide to scale-up the level of business. Probably, add one more big machine to your factory or hire more employees!

To scale up, you need more capital.

You approach a bank. Your friend has been filing ITRs even though he had income less than Rs 2,50,000 during the past years. But because you have not been filing your ITRs for whatever reason, the bank denies a bigger amount of loan or a business loan.

What a disappointment!

4. For applying to government tenders, some institutions require ITRs of the applicant. Both, the applicant’s business ITR and his individual ITR would be assessed.

5. Say, 5 years from now, you manage to squeeze in your savings, luckily get a small inheritance of property from your ancestors and manage to buy a fancy car. That would be a dream for most of us!

But, if you come under the radar of IT department in future and they question you about the assets you own, would you have an explanation of your accumulated wealth?

If you had filed your ITRs regularly, even if it is below the taxable limit, you can justify the expenses made by you.

Situation number 6. Coming under the scanner of IT department is an uncertainty, but you will only add to the probability of it if you do not disclose your income.

The question is, why not? Why not file an ITR even if you are below the income tax slab of Rs. 2.5 lakhs/ 3 lakhs / 5 lakhs ?

Are you lazy or just choose to be ignorant? That’s a question you should ask yourself!

7. Filing an ITR is a sign of honesty and has its own advantages listed as above. So, why not?

You aren’t hiding your earnings, so why the hesitation of not filing an ITR?

8. More over, if you have taxes deducted at source by your employer, or tax deducted on interest income of your bank account, claim a refund from the income tax department! It is your right!

IT department is very prompt in refunding TDS. File your ITR, claim your refundable money, you deserve it.

Want to know how to file your ITR if you are below the taxable limit? Leave a comment below.