As the pandemic hit India around March 2020, most of the stocks in the Indian market including BSE and NSE have seen a major hit. This has impacted investor confidence and has created a negative sentiment in the market. In such times, a company with an exceptional IPO gives hope to the market. The pandemic is not permanent and life will go on.

Hi, I am Stock Sandhya and I am passionate about the financial markets. I track new companies, IPOs, BSE, NSE and more. A detailed introduction about me is for an another day. Today, In this article, let’s look at a classic IPO – Rossari Biotech.

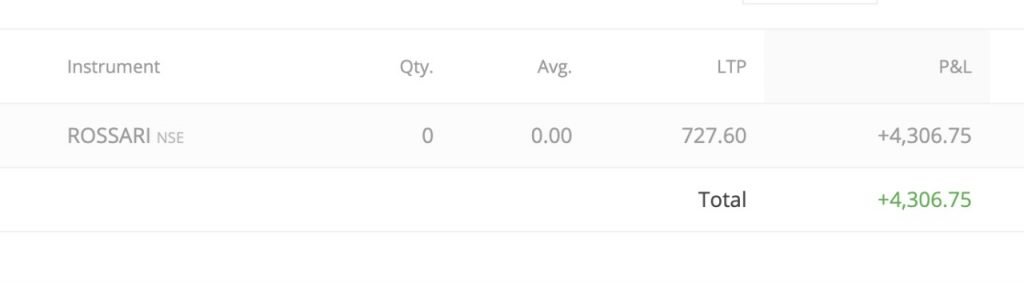

I bought this stock on Zerodha and did quick entry and exit making more than ₹4300 in profit in less than 30 minutes. Not bad right?

Rossari Biotech stepped into the BSE family bringing good omen during the COVID period and reflecting investor’s confidence by breaking many records of the Indian market with its consistency in delivering quality and results. Rossari Biotech issued its Initial Public Offer (IPO) on 13th of July 2020, with a minimum order being for a bid lot of 35 equity shares and in multiples thereof.

The price band was set between ₹423 – ₹425 for each equity share with a face value of Rs.2. The floor price being 211.50 times the face value and the cap price being 212.50 times the face value. Rossari Biotech announced its Rs 500 crores fundraising IPO, being the first mainboard IPO during the pandemic times and inconsistent markets.

Why Rossari Biotech?

- The company had an exceptionally successful IPO opening. 79x over-subscription is outstanding! It has a strong support of HNIs (240 times) and Qualified institutional buyers (85 times).

- On day one, Rossari Biotech got listed at 58% premium over its issue price, i.e. at Rs 670 a share. share price met the upper circuit at Rs 804 and showed a 75% gain. It also gained its name amongst the top 11 companies that listed with a premium over 50% in the past 5 years. BRAVO!

- Rossari Limited has a distributed risk because it does not depend on single space and also has a wide variety of products from animal care, poultry, textile, personal care etc. 2030 products in 18 countries! Whoa!

- It is also a manufacturer of disinfectants and sanitizers, which is now considered a necessity during the pandemic times, increasing its revenue share in personal care products up to 47% in FY 2020. Thus, guaranteeing a major portion to the revenue of the company until COVID is here to stay.

- The company is already the largest textile specialty chemical manufacturer in India while currently up scaling its capacity at Gujarat.

- Pre-IPO, the balance sheet analysis shows low leverage along with exceptional CAGR of 42% (FY 2017-2020) and CAGR EBITDA of 57% (FY 2017-2020) and the proceeds of IPO shall be used for the objectives mentioned above.

About Rossari Biotech: The entity started off as a partnership firm in 2003 and registered itself as a Joint stock company in 2009. It now has a wide variety of products in its portfolio and is one amongst India’s experts in specialty chemical manufacturers.

It also has diversified products in animal health and nutrition, personal care, home and performance chemicals. Rossari Biotech has its roots strongly in 17 countries, major in-house manufacturing units in Silvassa, R&D centers in Silvassa and Mumbai and an upcoming factory with advanced technologies in Dahej, Gujarat in 2021.

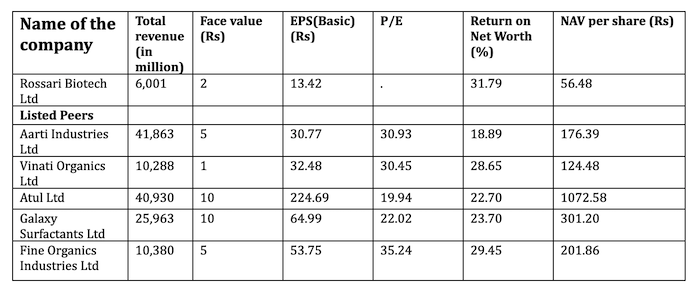

Fundamentals and Comparison with Peer Listed Companies

PE ratio based on the diluted EPS for the year 2020 of Rossari Biotech is at 32.12 while the average of its peers in the industry stands at 27.72 times.

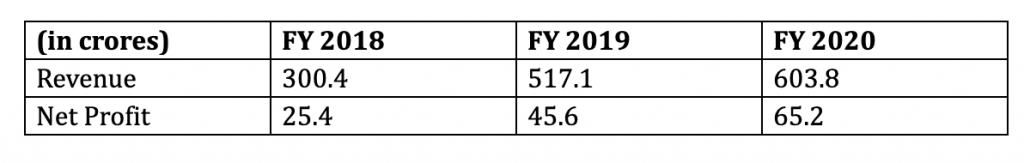

YoY Financials (Consolidated)

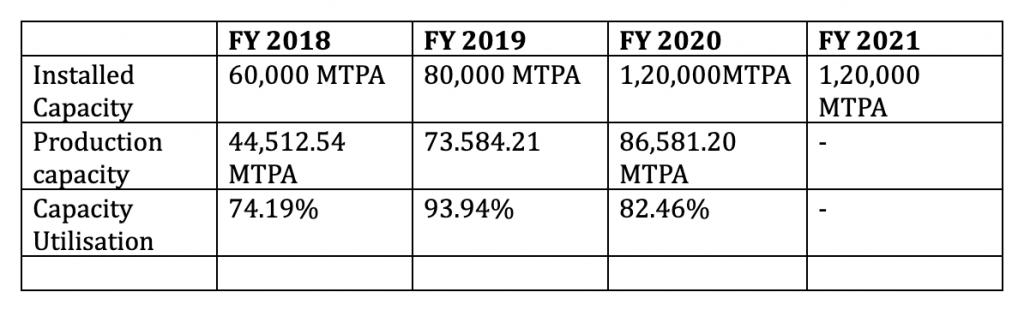

Comparison of Capacity Utilization

Silvassa Manufacturing Unit (Installed)

Dahej Manufacturing unit(Upcoming 2021) :

- Installed capacity:1,32,500MTPA

- Total Capacity utilization expected by FY 2021: 2,52,500 MTPA (1+2)

Big Names Amongst Investors

35.02 Lakh shares are allotted to a total of 15 anchor investors (12 Mutual funds via 48schemes). These anchor investors include SBI Mutual Fund, HDFC Life Insurance, Axis Mutual Fund, Abu Dhabi Investment Authority, Abu Dhabi Investment Authority, Sundaram Mutual Fund.

On 23rd of July 2020, Goldman Sachs India bought 4,81,433 equity shares in the star debutant Rossari Biotech at Rs.692.17 per share and secured 0.92% stake.

The company has low leverage, increased capacity utilization, better PE than the industry average, consistent quality delivery, better met working capital objectives post IPO and better return on the capital employed (ROCE).

[Disclaimer: The views shared in this article is the author’s opinion and does not count as a stock buying recommendation. The content here is curated and we DO NOT sell stock advice on this website. The author and the website bears no responsibility of the profits or losses made by the investor in investing in this particular stock, or any stock showcased on this website.]

In-depth information of recently listed script’s past performance, financial ratios and future prospects. Nicely written up and easy to understand even for new investors who are new to financial market. Awaiting for your next blog. All the best.

Thank you Priyesh! More articles on the blog. Read and enjoy 🙂